For anyone who has grown, produced, or sipped wine grown and made in the Empire State in the past decade, the notion that New York can make world-class wine feels like old, if not patently the-sky-is-blue-obvious, news. But for less lucky wine enthusiasts who have not had the pleasure, New York wine still often feels up-and-coming.

But that is set to change, now that winemakers, subregions and the New York Wine & Grape Foundation (NYWGF) are equipped with tools that will help them effectively communicate the evolution of the grape and wine industry here. In 2024, the NYWGF launched the first comprehensive vineyard survey done in New York since 2011.

It may seem like a technicality, but if everyone is relying on guesstimates and anecdotal evidence, it is hard to clearly and accurately convey what is actually happening on the ground with the gatekeepers of the industry, namely wine writers, sommeliers, and wine retailers.

“We are going to do the survey again in 2025,” explains Sam Filler, executive director of NYWGF. “Our goal is to get 75% participation at the minimum. It’s important to know what is planted where, and to track changes over time.”

The changes since the last survey have been significant. Filler says that in the past decade, the number of licensed wineries has grown from 285 to 513 in 2024. There have also been changes on the ground, with more growers putting in disease and pest-resistant varieties that require fewer chemical inputs, and cultivating grapes that will appeal to a younger and more diverse group of wine enthusiasts.

Bird’s Eye View of New York Vineyards

According to a vineyard scan by Deep Planet, a global Agri Tech company, New York has 29,586 acres of wine grapes under vine. The breakdown between AVAs may surprise some: Lake Erie has 17,653 acres, Finger Lakes has 9,035, Long Island has 1,987, Niagara Escarpment has 219, the Hudson River Region has 172, Upper Hudson has 31, and Champlain Valley has 24. The balance (465 acres) of acreage is not associated with an official region.

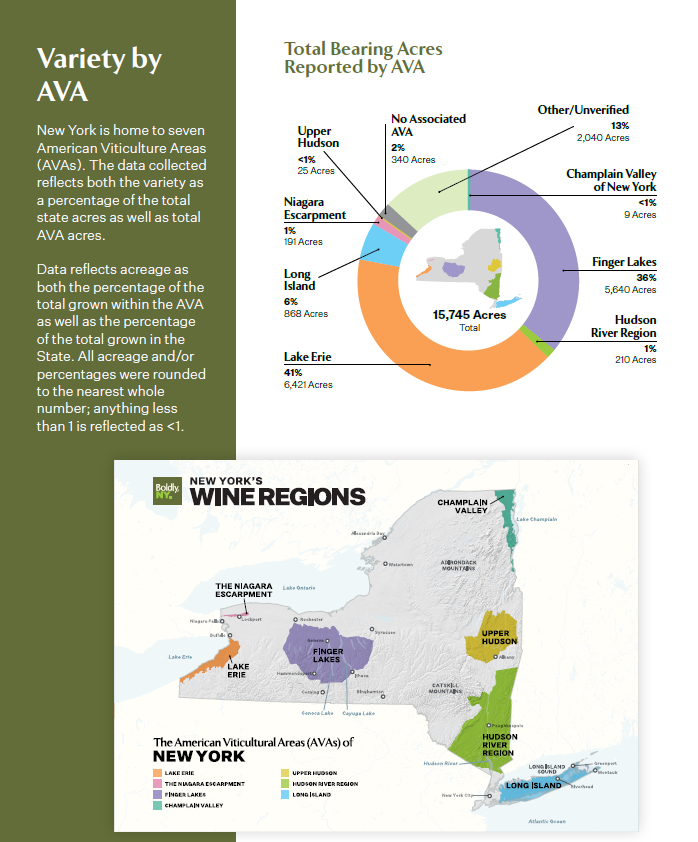

But the specifics of the report are based on data provided directly from growers, who submitted details on varieties grown on more than 15,745 acres of grapes. As it turns out, New York’s vineyards are rife with diversity: more than 134 varieties of grapes are grown across the state.

Drilling down, the grape distribution is fascinating. In Long Island, the top-planted grape is Merlot, with 177 acres under vine, making up 20% of the AVA’s total acreage, and 73% of the state’s total plantings of Merlot. Chardonnay is the top white, with 173 acres under vine, or about 20% of the AVA’s acreage, and 37% of the state’s total planting of Chardonnay.

In the Hudson River, Cabernet Franc is king, with 29 acres under vine, or 14% of the AVA’s total acreage, and 4% of the state’s total. Riesling is the No. 1 white there, with 18 acres under vine, or about 8% of the AVA’s total acreage, but just 2% of the state’s total planting of Riesling.

For the Finger Lakes, Concord is the most widely planted red grape with a reported 1,058 under vine, or 19% of the AVA’s total acreage, and 16% of the state’s total Concord plantings. Riesling tops the whites, with 832 acres under vine, or 15% of the AVA’s total acreage, and a whopping 90% of the state’s total planting of Riesling.

There are other important takeaways: American grapes (like Concord) dominate plantings with 7,404 under vine; Hybrids (like Aurora) are next, with 4,494 acres under vine); and Vinifera (like Riesling) comes in third at 3,826 acres.

Priceless Communication, Investment, and Planning Tool

The results of the survey aren’t just delicious fodder for grape geeks—they serve as an essential educational foundation for investment and marketing purposes, says Colleen Crill, managing director of Agency 29, a marketing firm dedicated to growing beverage brands.

Agency 29 was also instrumental in helping NYWGF conduct and compile the report.

“This survey allows us to be a better partner to grape growers,” Crill says. “Knowing what grapes are being grown allows NYWGF, the State, and Cornell Cooperative Extension to be better stewards of the industry when it comes to investments in research, effective marketing, and when responding to adverse weather events like the 2023 frost.”

The data in the report will fuel future innovation and growth, and because it will be easier to track moving forward, it will be simpler to capitalize on emerging trends. Next time, the report will be even more expansive.

“It will include pricing information, as well as data on non-bearing acreage and production tonnage,” Crill notes. “This isn’t a see-it-and-forget-it process. Our ongoing database development ensures we’ll have up-to-date information for actionable outcomes.”

Industry members like Bob Madill, Chair of the NYWGF Promotions Committee, says data like this is a boon for growers and producers in an increasingly competitive market.

“Wineries and growers will have a general idea from the survey results of the extent of each variety and some trends,” Madill notes. “This will inform both planting and wine production decisions. Without it, the industry would be operating without accurate knowledge of its own scope and impact, and without a means to determine the optimum use of private and public resources in planning for the future.”

Thirsty for even more? A full copy of the report, with details on the methodology, can be accessed here.